At Kian Finance Authority, we are dedicated to providing you with the most comprehensive resources for your tax education training needs.

Whether you want to excel in taxation or seek audit tax and consulting services, we have you covered. Explore our range of study guides and books to enhance your knowledge and prepare you for success.

Self-Study Guides: Unlock Your Potential

Are you ready to take the EA and AFTR/AFSP exams? Look no further.

We have all the tools you need to succeed, including exam review materials, effective study strategies, and valuable study tips.

With Kian Finance Authority, you can access these resources from the comfort of your own home. Our webinars and study aids are just a click away, allowing you to advance your knowledge at your own pace.

Whether you’re an experienced EA or just starting, our concise guides cover the fundamentals of taxes and bookkeeping, ensuring you stay up-to-date with the latest developments.

Bookkeeping for Success: A 3-in-1 Guide

Our “Bookkeeping for Success” guide is a comprehensive resource that covers introductory, mid-level, and advanced bookkeeping fundamentals. No jargon, just clear explanations to help you understand:

- Statement of Owner’s Equity and Financial statements such as P&L and Balance Sheets.

- The Chart of Accounts.

- The break-even point.

- Adjusting entries at year-end.

- Closing the accounts.

- Financial Accounting and Managerial Accounting Essentials.

Make informed decisions about your financial future with ease.

Fundamentals of Individual Tax Preparation: Your Ultimate Guide

Prepare for tax season like a pro with our “Fundamentals of Individual Tax Preparation” guide. Dive into crucial topics such as:

- Filing Status as defined by the IRS.

- Qualifying Dependents.

- Various income types and tax rate structures.

- Income adjustments to optimize your tax bracket.

- Deductions: Itemize or use Standard Deductions?

- The QBI and its benefits.

- Tax Credits to maximize returns.

Our guide, Ferey Kian’s guide, presents these concepts in a simple, organized manner, ensuring you have the knowledge you need to assist your clients effectively.

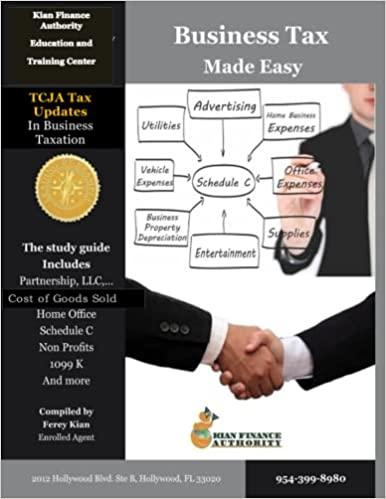

Business Tax Made Easy: Simplifying Complexity

Navigating business taxes can be challenging, but with “Business Tax Made Easy,” we simplify the process. Learn about:

- Choosing the right business type.

- Business income classification.

- Business deductions and credits.

- Strategies to audit-proof your business.

Master the art of analyzing income, gains, deductions, and credits to effortlessly guide your client’s financial success.

Enrolled Agent Test Preparation Books: Your Path to Expertise:

As the best tax education provider, our Enrolled Agent, test preparation books are the key to unlocking your tax expertise.

Whether you’re pursuing Part I: Individual Tax Preparation, Part II: Business Tax Preparation, or Part III: Representation, we’ve got you covered.

- Part I: Individual Tax Preparation Exam offers step-by-step guidance, sample tests, and solutions to help you pass with flying colors. Join our live Zoom sessions or attend in-person workshops in Hollywood to enhance your learning experience.

- Part II: Business Tax Preparation Exam delves into essential business tax topics, provides examples of previous test questions, and equips you with strategies to maximize your success. If you prefer a hands-on approach, our live Zoom sessions and face-to-face workshops in Hollywood, FL, are available.

- Part III: Representation Exam focuses on ethical issues related to tax preparation. Learn about representing clients before the IRS and handling levies, liens, and collections. Elevate your career with our comprehensive study guide.

Ready to become a tax expert? Kian Finance Authority is here to support you every step of the way. Join us in Hollywood, FL, for live workshops or explore our study materials to make your learning experience seamless and practical.

Furthermore, we offer the following courses:

1. SEE Part II: Business Tax preparation Exam:

This study guide focuses on Business Tax questions you need to know to pass the SEE Part II test.

This book goes over the tax topics with ample examples of the questions that previously appeared in tests. It also shows how to dissect questions and how some answers could be too close to call. Learn how to eliminate wrong answers and increase your chances by 50%.

- The business tax goes over hot topics such as the Basis for partners or S corporation shareholders,

- taxability of Dividends received from shares in other companies (to avoid triple and quadruple taxation),

- Profit and Loss, as well as a discussion on

- Retained Earnings,

- Balance sheet, and

- Net Operating Loss carry forward and much more.

If you have a Kindle from Amazon, you pay a fraction of the cost for each of the EA preparatory study guides. If you like to highlight and jot down notes in the margins, here’s your help to pass SEE Part II.

If you like to meet on live Zoom or attend face-to-face workshops in Hollywood, FL, give us a call or register for EA Preparatory Workshop.

Join Us Today!

Connect with us on Facebook and Twitter. In addition, follow our Business Finance Blog for valuable updates and tips to apply immediately to your financial strategies.

For those seeking a self-study guide, consider ordering our comprehensive “Study Guides: All Three Parts of the IRS Special Enrolled Agent Examination (SEE)” for only $149.

At Kian Finance Authority, we are your GPS in Finance, guiding you to success by evaluating your strengths and opportunities.

Trust us to be your tax education provider; we shall help you shine globally while securing your financial future. Don’t speak to the IRS agent until you’ve talked to us first – our initial consultation is free, and the benefits are priceless.

Thank you for considering Kian Finance Authority as your trusted ‘business consultant near me.’ We look forward to helping you achieve your economic aspirations and realizing your business dreams.